SWISS DEBT RECOVERIES

Experts in Swiss debt recoveries

Chase Mckenzie provides a dedicated fixed fee service across all four main stages of the Swiss debt recovery process, including Letter Before Action (LBA), Issuing Court Claims, obtaining a County Court Judgment (CCJ), Enforcement of a CCJ, and additionally if necessary Insolvency Proceedings.

Our research shows that on average, 86% of cases result in payment at the letter before action stage, with no further action being required. You can learn more about the subsequent steps in the process that follow the sending of a Letter Before Action below.

Click here for a detailed price list.

Before issuing any legal proceedings a letter before action (LBA) should be sent to a debtor. An LBA can be sent for as little as $1.50 plus VAT and on average, 86% of cases result in payment at this stage.

If you send a letter before action to your debtor but you do not receive a satisfactory response then the next stage in the legal process is to issue legal proceedings through the County Court. The debtor will be sent a court form requiring them to pay the debt, plus interest and costs within 14 days.

A County Court Judgment (CCJ) is a Court Order that confirms that the debtor has defaulted on payment. A CCJ can be obtained immediately after the expiry date of the County Court Claim. The CCJ is the final decision by the Court which gives you the power to take enforcement action in order to collect the debt.

Once a County Court Judgment has been obtained, it is then possible to ‘enforce’ that debt immediately. At Chase Mckenzie our paralegals will always advise on the most appropriate method of enforcement based on their experience and expertise with similar cases.

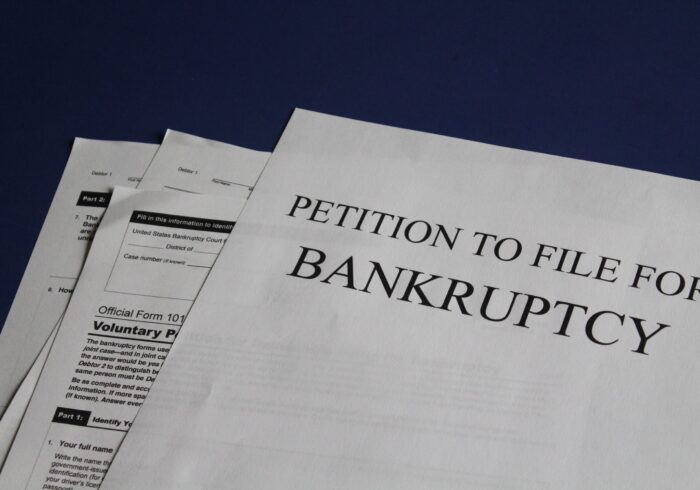

Across all stages of debt recovery, insolvency proceedings may be required. If a debtor does not make payment on demand and the debt is not disputed, they are technically deemed insolvent.

Before issuing any legal proceedings a letter before action (LBA) should be sent to a debtor. An LBA can be sent for as little as $1.50 plus VAT and on average, 86% of cases result in payment at this stage.

If you send a letter before action to your debtor but you do not receive a satisfactory response then the next stage in the legal process is to issue legal proceedings through the County Court. The debtor will be sent a court form requiring them to pay the debt, plus interest and costs within 14 days.

A County Court Judgment (CCJ) is a Court Order that confirms that the debtor has defaulted on payment. A CCJ can be obtained immediately after the expiry date of the County Court Claim. The CCJ is the final decision by the Court which gives you the power to take enforcement action in order to collect the debt.

Once a County Court Judgment has been obtained, it is then possible to ‘enforce’ that debt immediately. At Chase Mckenzie our paralegals will always advise on the most appropriate method of enforcement based on their experience and expertise with similar cases.

Across all stages of debt recovery, insolvency proceedings may be required. If a debtor does not make payment on demand and the debt is not disputed, they are technically deemed insolvent.

If you are concerned that your debtor may have other creditors chasing payment from them, commencing Winding Up Proceedings against a company or Bankruptcy Proceedings against an individual means you could jump straight to the front of the queue for payment.

Instead of the usual process of issuing a County Court Claim, you can commence insolvency action by initially sending a Draft Winding Up Petition to a company or a Statutory Demand to an individual. On average 81% of cases are paid at this stage without further insolvency proceedings being issued.